Smart Billing & Invoicing Software Built for Travel Agencies

Easily manage payments, automate invoicing, and generate detailed reports—so you focus more on travel, and less on paperwork.

Designed for the Way Travel Agencies Work

- Split commissions with ease

- Manage B2B/B2C invoices

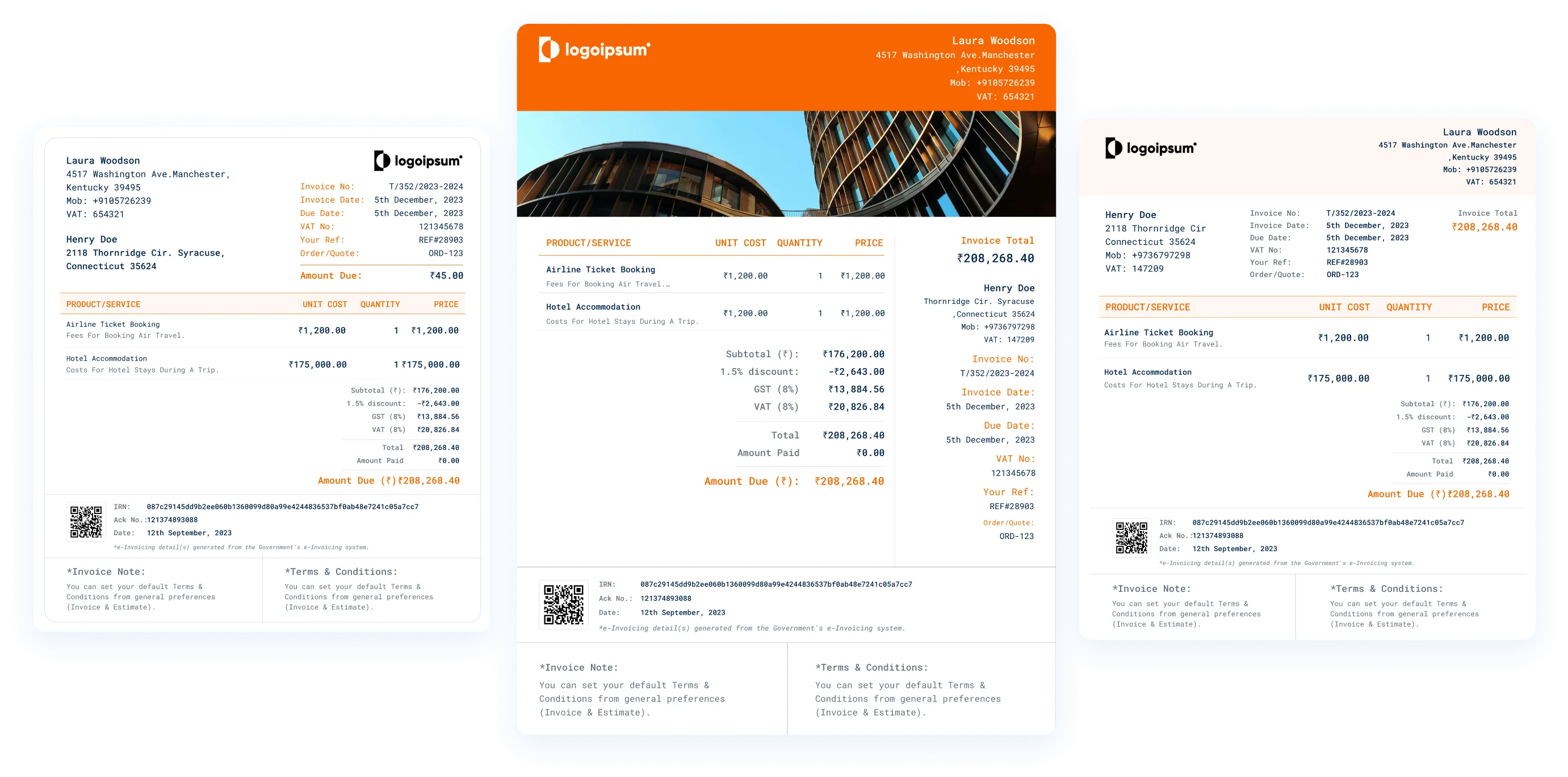

Create Professional Invoices in Minutes

- Destination-themed layouts

- Branded headers and footers

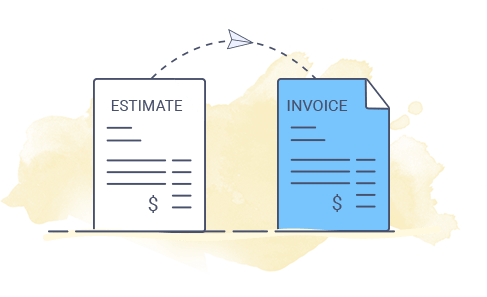

From Quote to Payment—All in One Place

- Send quotes, convert them into invoices

- Link payments to PNRs or booking IDs

Connect with the Tools You Already Use

We integrate with major GDS systems, booking platforms, and payment gateways for a truly connected experience. Choose from travel-focused invoice designs that are fully editable and reflect your brand. Email or download in one click.

Track, Collect & Reconcile Payments

Never miss a payment again with real-time tracking, automated reminders, and seamless reconciliation. Stay on top of every transaction and ensure no invoice goes unnoticed or unpaid—ever again.

Monitor outstanding balances

Get a real-time view of all pending payments, broken down by customer, supplier, or booking. Easily identify overdue invoices and follow up directly from your dashboard. No more manual tracking or spreadsheet chaos.

Accept partial or split payments

Offer your clients more flexibility by enabling partial payments, deposits, or split invoices across multiple payers. Whether it's a group tour or corporate booking, our system keeps everything aligned and accounted for.

Export to accounting tools in 1 click

Seamlessly sync all your financial records with your favorite accounting software like QuickBooks, Xero, or Tally. Generate export-ready reports in a single click and stay audit-ready with organized digital trails.

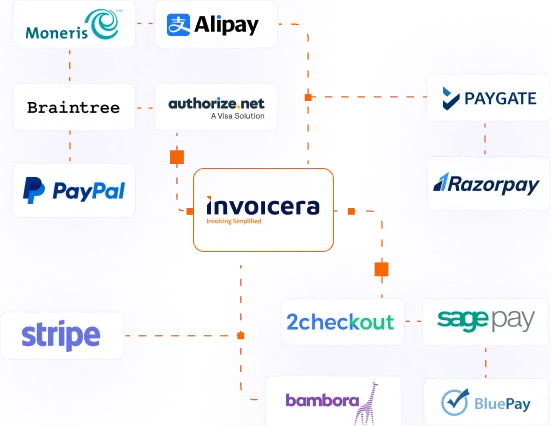

Do More With Integrations

Connect seamlessly with leading global payment gateways to simplify transactions, reduce manual work, and offer your clients the flexibility to pay the way they prefer.

Accept payments through PayPal, Stripe, Razorpay, 2Checkout, Braintree, and more—all from a single platform.

Everything You Need, Nothing You Don’t

Travel agencies choose us for our purpose-built tools, smart automation, and seamless integrations. We deliver exactly what you need—fast invoicing, real-time tracking, and powerful reporting—without unnecessary complexity.

Save hours in manual invoicing

Automate the entire invoicing process—from quote creation to final payment—so your team doesn’t have to spend hours manually entering details. Generate accurate, professional invoices with just a few clicks. This frees up your time to focus on customer service, sales, and growing your travel business rather than drowning in routine paperwork.

Get paid faster with smart reminders

Boost your cash flow with automated payment reminders that gently nudge customers before and after due dates. Customize reminder frequency and tone to suit your client relationships. This proactive approach minimizes follow-ups and ensures timely payments, helping you maintain steady revenue without needing to chase down every pending invoice.

Full control over commissions & markups

Whether you work with sub-agents, suppliers, or B2B partners, our platform gives you complete flexibility to define, track, and adjust commissions and markups per transaction. Apply specific rates based on service type, booking volume, or client category. No more hidden errors—just clear, accurate profit calculations with every invoice.

100% cloud-based—access from anywhere

Run your travel business from the office, your home, or while on the move. Our cloud-based system lets you manage billing, monitor payments, and generate reports from any internet-connected device. All data is securely stored and updated in real time, giving your team full access and control, anytime, anywhere.

Works with your current booking system

No need to overhaul your existing workflow. Our software integrates effortlessly with your current booking engine, GDS, or CRM tools. Map invoices to booking references, auto-sync payment statuses, and streamline operations without needing multiple logins or duplicate data entries. Keep everything aligned and connected across your travel ecosystem.

Generate detailed reports for better decision-making

Stay on top of your financial health with in-depth reporting on revenue, outstanding payments, customer behavior, and agent performance. Use real-time insights to identify top clients, high-margin services, or potential leakages. These actionable reports empower you to make informed decisions that drive profitability and business growth.

Built-in Features Travel Agencies Love

All-in-one features crafted for the unique needs of modern travel professionals. From quoting to reconciliation—do more with less effort.

Quote to Invoice in 1 Click

Convert travel quotes into professional invoices instantly. No need to re-enter data—just click and send, saving time and avoiding manual errors.

Multi-Currency Handling

Bill clients in their preferred currency. Automatically apply real-time exchange rates and manage multiple currencies across international clients and suppliers without hassle.

GST/VAT Calculations

Ensure compliance with automatic GST/VAT calculations. Apply region-specific tax rules, generate tax-ready invoices, and export reports for effortless filing and audits.

Real-Time Payment Sync

Track payments as they happen. Our system syncs payment statuses in real time, so you always know which invoices are paid, pending, or overdue.

Email + PDF Invoices

Send invoices via email with a downloadable PDF attached. Your clients receive professional-looking invoices instantly, improving communication and speeding up payment cycles.

Branded Invoice Templates

Customize invoice templates with your agency’s logo, colors, and footer notes. Leave a lasting impression while maintaining brand consistency across every client interaction.

Agent-wise Billing

Track bookings and payments agent-wise. Assign commissions, analyze agent performance, and simplify payouts for your in-house or external sales team.

Tour & Activity Group Billing

Bill for complete tour packages or activities in one go. Bundle multiple services into a single invoice, perfect for group tours or multi-day itineraries.

B2B Partner Reconciliation

Reconcile transactions with B2B partners effortlessly. Share statements, track receivables, and manage bulk bookings or agent credit accounts from a centralized dashboard.

Advantages of using adivaha®’s Billing, Invoicing & Reporting Software

Why travel agencies and tour operators trust adivaha® to manage their financial operations efficiently and accurately

Save Time on Every Booking

Automated workflows eliminate manual invoicing and repetitive data entry. Create, send, and reconcile invoices within minutes, freeing your team to focus on sales and service—not spreadsheets.

Convenient Online Payments

Offer secure online payment options with support for global gateways. Customers pay faster when it’s easy, and you enjoy seamless transaction tracking—no matter where your clients are.

Reduced Admin Overhead

From tax calculations to payment tracking, our system handles the complex tasks in the background. Say goodbye to manual reconciliation and hello to a streamlined finance operation.

Get Paid Faster

Smart reminders, automated receipts, and online invoicing lead to quicker payment turnarounds. Many adivaha® users see their payment cycles cut by half within the first month.

Lower Payment Failures

Reduce errors and missed follow-ups with real-time payment updates and system alerts. Our intelligent dashboard keeps you in control of every transaction—no missed invoices, no lost revenue.

Whether You’re Solo or Scaling, We’ve Got You Covered

From independent consultants to enterprise DMCs, our billing and reporting solution adapts to your business size, complexity, and pace of growth.

Individual Travel Consultants

Perfect for solo agents who need quick invoicing, payment tracking, and reporting without the complexity of large systems.

Small Travel Agencies

Streamline operations with built-in automation, professional invoices, and simplified reconciliation to grow your client base efficiently.

Large Tour Operators

Handle high volumes, complex itineraries, and multi-agent commissions with ease—our system scales with your needs.

DMCs (Destination Management Companies)

Manage multiple suppliers, bundled packages, and regional tax rules effortlessly with detailed reporting and B2B account handling.

Corporate Travel Managers

Track bookings per employee or department, automate billing cycles, and ensure compliance with detailed analytics and cost center reports.

Consolidators & Affiliates

Offer white-label billing portals, manage agent credit lines, and handle bulk bookings with centralized control and full financial visibility.

Billing, Invoicing & Reporting Software for Travel Agencies

Managing finances is the backbone of every business. From charging customers to tracking expenses, the systems behind billing, invoicing, and reporting must be accurate, efficient, and scalable. In today's digital-first economy, automating these operations not only enhances efficiency but also ensures financial compliance and data-driven decision-making.

Understanding the Differences: Billing vs. Invoicing vs. Reporting

What Is Billing?

Billing is the process of generating a statement of money owed by customers for goods or services provided. It may be done periodically (e.g., subscription-based billing) or upon service completion.

What Is Invoicing?

An invoice is a formal, itemized bill sent to customers detailing products or services provided, costs, and payment terms. It's an essential legal document for accounting and tax purposes.

What Is Reporting?

Reporting in finance refers to the generation of analytical summaries that reveal financial health, trends, or irregularities. It includes profit/loss statements, audit trails, tax summaries, and performance dashboards.

Why Modern Businesses Need Automated Billing and Invoicing

Time and Cost Efficiency

Manual invoicing takes time and is error-prone. Automation significantly reduces time spent on routine billing tasks and eliminates costly mistakes.

Billing, Invoicing & Reporting Software

Improved Cash Flow Management

With timely billing and invoice reminders, companies can reduce delayed payments and improve working capital.

Compliance and Accuracy

Automated invoicing ensures alignment with tax regulations, local laws, and audit requirements.

Customer Satisfaction

Professional, error-free invoices and transparent billing lead to better customer trust and retention.

Reporting: Transforming Data into Actionable Insights

Real-Time Financial Reporting

With real-time dashboards, businesses can make faster decisions by monitoring cash flow, revenue, and customer payments.

Custom Reports and Forecasts

Modern platforms allow tailored reports—by geography, product line, customer segment—which help identify revenue opportunities or inefficiencies.

Audit Trails and Compliance Logs

Automatically track changes, generate audit logs, and maintain documentation to satisfy regulatory bodies.

Key Features to Look for in Billing, Invoicing & Reporting Software

Automation & Scheduling

Set up recurring bills and invoices for subscriptions or retainers, reducing manual work.

Multi-Currency & Tax Handling

Handle global clients with features supporting multiple currencies, tax rates, and compliance with VAT, GST, etc.

Integration Capabilities

Seamless integration with CRM, ERP, and payment gateways ensures a connected financial ecosystem.

Custom Branding & Communication

Professional invoices reflect your brand and improve communication with clients via reminders and confirmations.

Secure Cloud Access

Cloud-based solutions offer anytime-anywhere access with encrypted security and role-based permissions.

Industry Use Cases

SaaS and Subscription Services

Automated recurring billing with real-time analytics for churn prediction and customer lifetime value (CLV) tracking.

Freelancers and Small Businesses

Invoice templates, one-click payment links, and simplified tax reports help solo entrepreneurs stay compliant.

Enterprises and Large Corporations

Advanced reporting, bulk invoicing, and cost-center-level tracking to manage complex financial structures.

Best Practices for Billing, Invoicing, and Reporting

Ensure Clarity in Documentation

Avoid confusion by using clear item descriptions, pricing, and payment terms in invoices.

Use Dynamic Reporting Dashboards

Visual dashboards help stakeholders grasp key financial metrics at a glance.

Schedule Regular Financial Reviews

Monthly and quarterly reviews using generated reports help identify areas of concern before they escalate.

Maintain a Digital Archive

A searchable, centralized digital archive ensures audit-readiness and financial transparency.

Compliance, Taxation, and Legal Considerations

Billing and invoicing must comply with local and international standards such as:

Automated systems should be updated regularly to comply with these evolving standards.

How to Choose the Right Financial Management Platform

Assess Your Business Needs

Consider transaction volume, team size, and complexity before selecting a platform.

Evaluate Support and Scalability

Ensure the platform can scale with your growth and has a responsive support team.

Consider Usability and User Experience

Even the best features are useless if your team struggles to navigate them. Choose intuitive interfaces.

Common Challenges and How to Overcome Them

Late Payments

Use automated reminders and offer multiple payment options to encourage on-time payments.

Invoice Discrepancies

Implement checks before sending invoices and offer a dispute resolution workflow.

Reporting Errors

Use validation rules and cross-checks to ensure reporting accuracy.

Future of Billing, Invoicing, and Reporting

AI and Machine Learning

AI can predict late payments, suggest pricing optimizations, and automate fraud detection.

Blockchain in Invoicing

Blockchain can create immutable audit trails and smart contracts for instant payment processing.

Embedded Finance

Future systems will integrate deeper into workflows, enabling on-the-spot financial operations inside CRMs or ERPs.

Empower Your Business with Smart Financial Tools

Billing, invoicing, and reporting aren’t just administrative tasks—they’re strategic levers for better business performance. Whether you're a startup founder, freelancer, or CFO of an enterprise, investing in the right financial tools will improve cash flow, ensure compliance, and enable data-driven growth.

Frequently Asked Questions

Everything you need to know before getting started—clearly explained, with zero jargon. If it matters to your agency, we’ve already thought of it.